Corn investors have been on one hell of a roller coaster ride recently.

From mid 2010 to mid 2012, corn prices soared from $3.50 to $8.30 a bushel, or some 137% in just two years.

Then came a precipitous plunge in 2013 back down to the $4.00 area as new cornfields helped produce a bumper crop of a record 14 billion bushels.

However, according to a new study that examined extreme weather risks facing U.S. corn production, the volatile ride in corn prices is far from over.

Researchers Brooke Barton and Sarah Elizabeth Clark of the non-profit group Ceres recently presented a highly detailed case that America’s Corn Belt is about to get crushed.

3 Major Threats

According to Barton and Clark, there are three major threats to U.S. corn production on the horizon: extreme weather conditions, unsustainable water use, and inefficient and damaging fertilizer practices.

Investors should take note.

Dry weather, heat waves, and devastating floods are not allies of corn growers. But that’s exactly what may be in store.

And according to the researchers, we should fully expect a trend of extreme weather to accelerate, marked by “increased occurrence of higher temperatures during early spring… increased occurrence of cold air outbreaks during the spring… warmer and longer winters… increased frequency and intensity of heat waves and drought… increasing intensity and frequency of extreme precipitation events.”

I’m bullish corn!

After all, consider the following…

- Small but long-term increases in average temperature shorten the reproductive development period of corn, contributing to yield declines (even when offset by increased CO2 fertilization).

- Heat waves during pollination of corn decrease yields.

- Increase in ‘overwintering’ insect populations has allowed some pests and weeds to survive warmer winters.

- Wetter springs reduce yields if farmers switch to late-planted, shorter-season varieties.

- Increased run-off and flooding will increase nutrient run-off, decrease water quality, and erode soils.

As a result of these weather effects, corn yields are expected to decline by as much as 18% to 30% from 2020 to 2049 and 38% to 85% from 2070 to 2099.

Yes, under the worst-case scenario, corn yields in the U.S. could drop by 85% by the end of this century.

Irrigation Demand and Water Stress

Living in the United States, most folks — even during drought conditions — often take for granted the readily available supply of water. But not farmers.

This is why a number of them are now rightly concerned that corn crops will be subjected to more intense but less frequent precipitation.

Barton and Clark’s report explains that “maintaining crop production in the Corn Belt will require a 5-25 percent increase in irrigation,” which would therefore “contribute to existing stress on surface and groundwater sources.”

“Corn is a thirsty plant,” the study underscores, “and receives the most irrigation water of any American crop.”

Making matters worse is that the increase in corn demand over recent years due to ethanol requirements has lead to an expansion of corn farming into regions that have not supported corn before, creating an imbalance in water use in those new corn-growing areas.

“This imbalance has been driven by expansion of corn acreage in areas of traditional dryland farming coupled with chronic over-extraction of groundwater, particularly in the High Plains aquifer,” the report explains.

As a result of corn’s expansion into these drier areas, “Over half of the country’s irrigated corn production depends on groundwater from the over-exploited High Plains aquifer.”

In Western Kansas, more than 30% of the aquifer’s total volume has already been withdrawn, with another 39% projected to be pumped over the next 50 years.

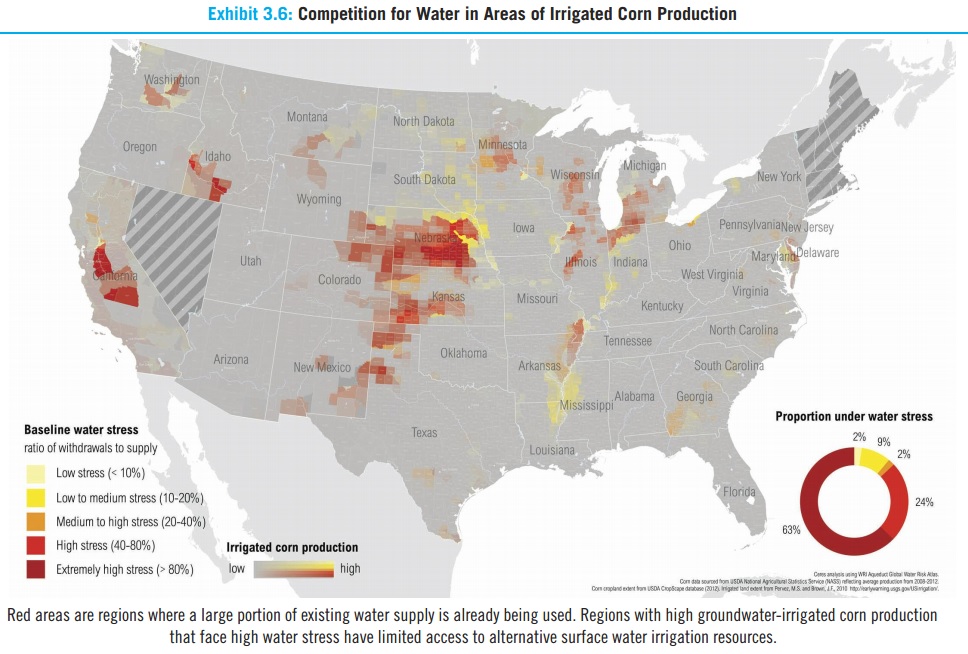

“In some corn-growing regions of the Midwest and Great Plains, nearly all available water is already allocated to existing agricultural, municipal and industrial users,” the study points out. “The analysis found that 35 percent of total U.S. corn production is taking place in regions with high to extremely high water stress, meaning in regions where the ratio of water withdrawals to renewable supplies exceeds 40 percent on an average annual basis.”

As the map below indicates, the most vulnerable regions are Nebraska, Kansas, California, Colorado, and Texas, where more than 80% of renewable water supplies are already being used.

Researchers note that high water stress levels mean there is very little additional surface water available to augment irrigation.

This is why droughts are so devastating. In such years, irrigation withdrawals exceed fresh supplies, removing vast amounts of water from underground aquifers that may never be replenished given the high rate at which they are tapped even in years of normal precipitation.

Corn in your Gas Tank

Of course, there is little in the way of disclosure to investors. And certainly the government sold Americans a bad deal on ethanol when it mandated that we put corn in our gas tanks.

That being said, even with this latest study, little will change because few CEOs can see beyond the next quarter and few politicians can see beyond the next campaign. So my advice is simple…

Get some exposure to corn, either through an ETF like Teucrium Corn (NYSE: CORN) or through a Big Ag play like Monsanto (NYSE: MON) or Mosaic (NYSE: MOS).

Yes, these companies are partly responsible for the degradation of our once-arable land. But they benefit handsomely from it, too.

Of course, if your conscience gets in the way of such an investment (as it does for me), consider making the safest investment in corn you can possible make: Buy land and grow your own — organically.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter